The All In One Platform

For Business Marketing

Local

Coaching

Consulting

E-commerce

Local

Transform how you run your business with our all-in-one platform. Built for business owners looking to get ahead.

Scale faster, & save more time.

$1,949+

Monthly Savings by replacing multiple tools with one platform that does it all.

30+

Software platforms replaced. Streamline your operations with our all-in-one CRM for local businesses.

20%

Increase in sales conversions reported by users who implement our fast-five lead follow-up system.

Features at a glance

Replace all other platforms and tools with one software that does it all.

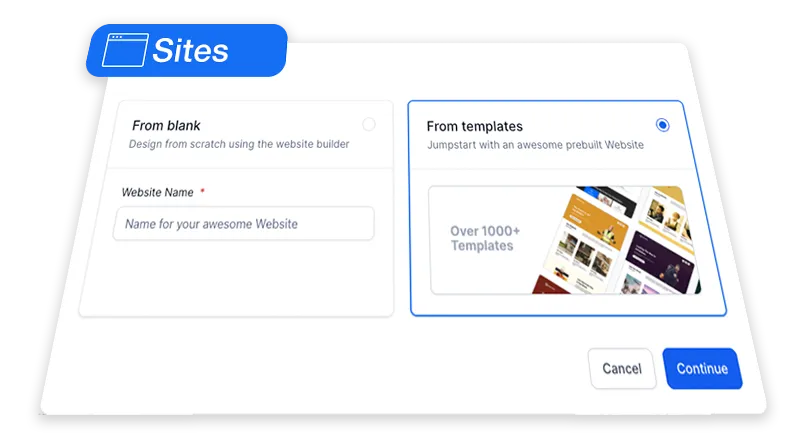

Design Websites & Funnels

Create websites in seconds with our library of templates that are ready to go.

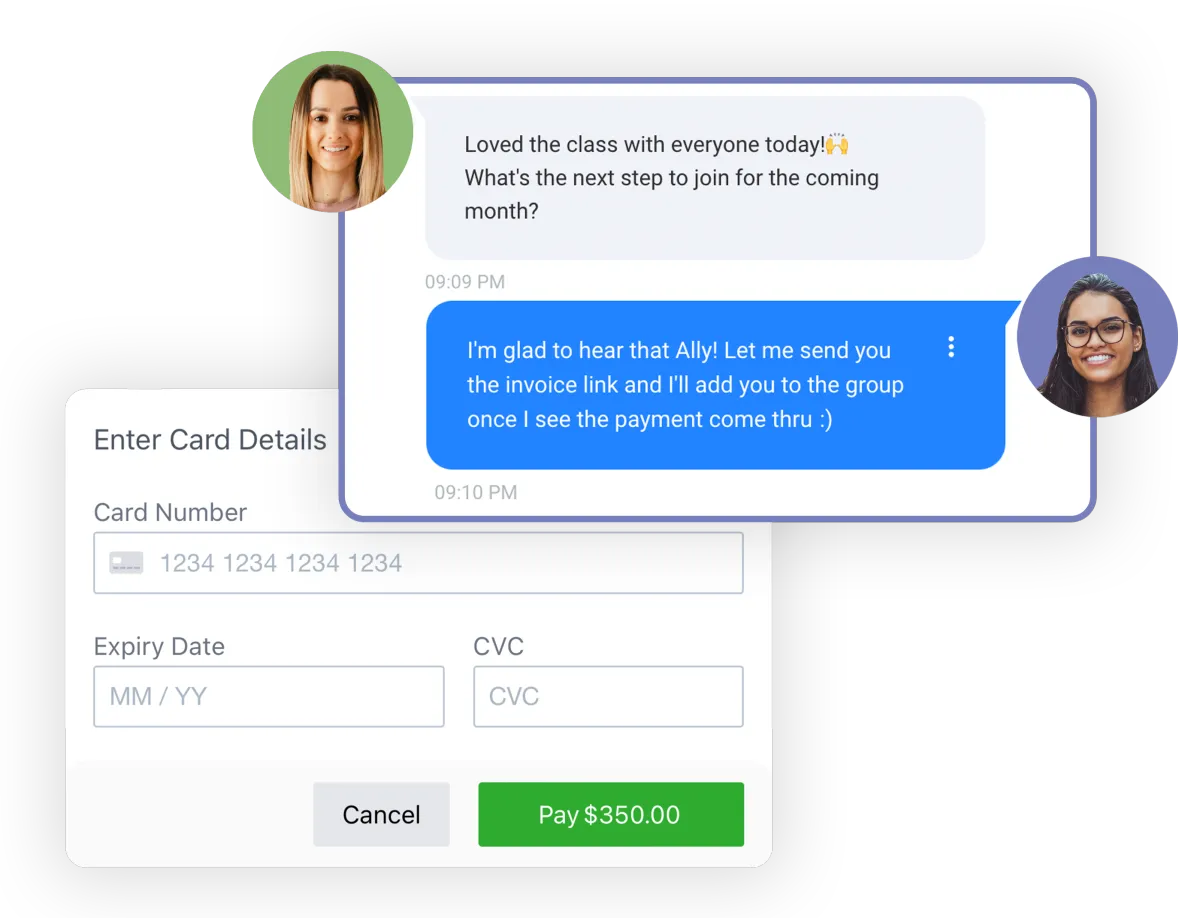

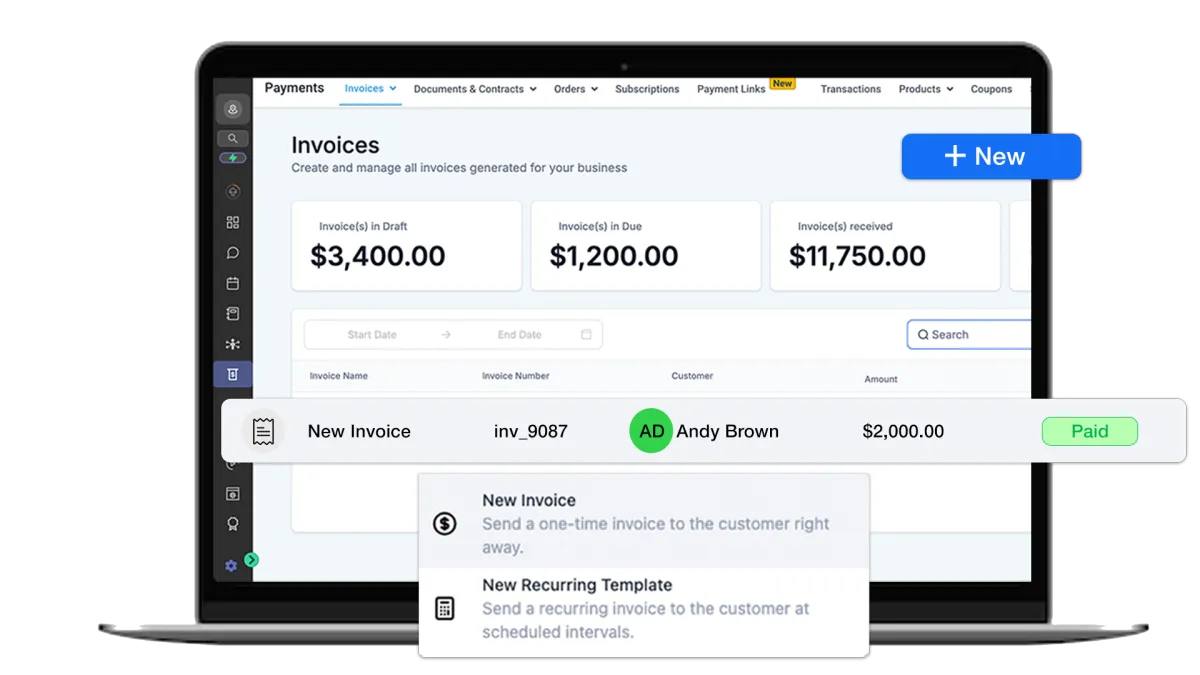

Create Invoices & Receive Payments

Charge customers via email or text with Stripe.

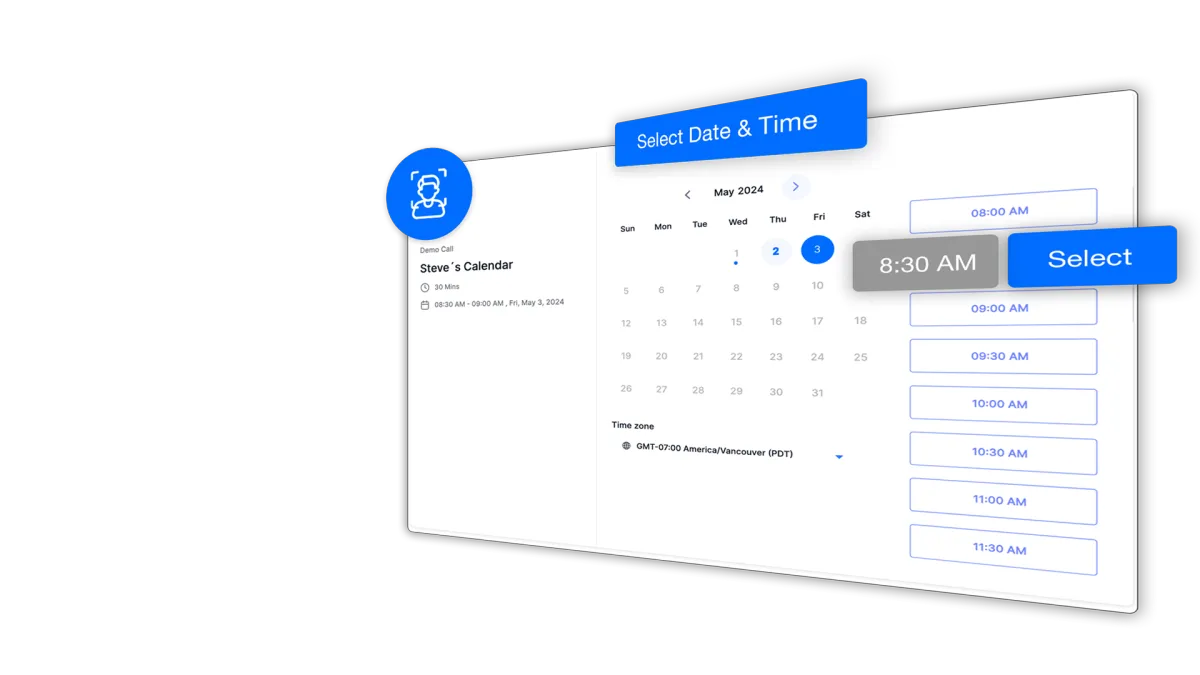

Manage Your Calendar & Appointments

Schedule clients appointments and manage your calendar.

Run SMS & Email Campaigns

Schedule clients appointments and manage your calendar.

Manage Pipelines & Deals (CRM)

Track your business stats. See your monthly performance.

Build Courses & Communities

Track your business stats. See your monthly performance.

Launch

E-commerce Stores

Sell digital and physical products with our e-commerce stores.

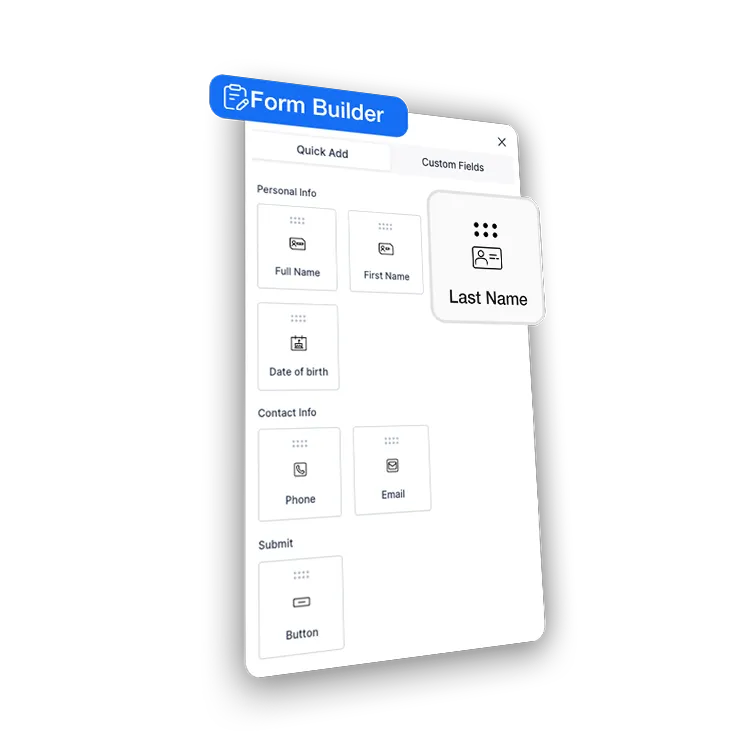

Make Client Forms & Surveys

Collect client info with custom forms.

Everything in one easy to use

Platform

Optimize your schedule

Effortlessly manage appointments, bookings, and events with our Calendar feature.

Easier for leads to become clients

Create highly-engaging forms that get clients to get in contact with you.

Build an audience and get paid for it

Have a loyal following?

Offer courses & memberships for added value to your community.

Websites that convert

Create stunning websites & turn clicks into clients.

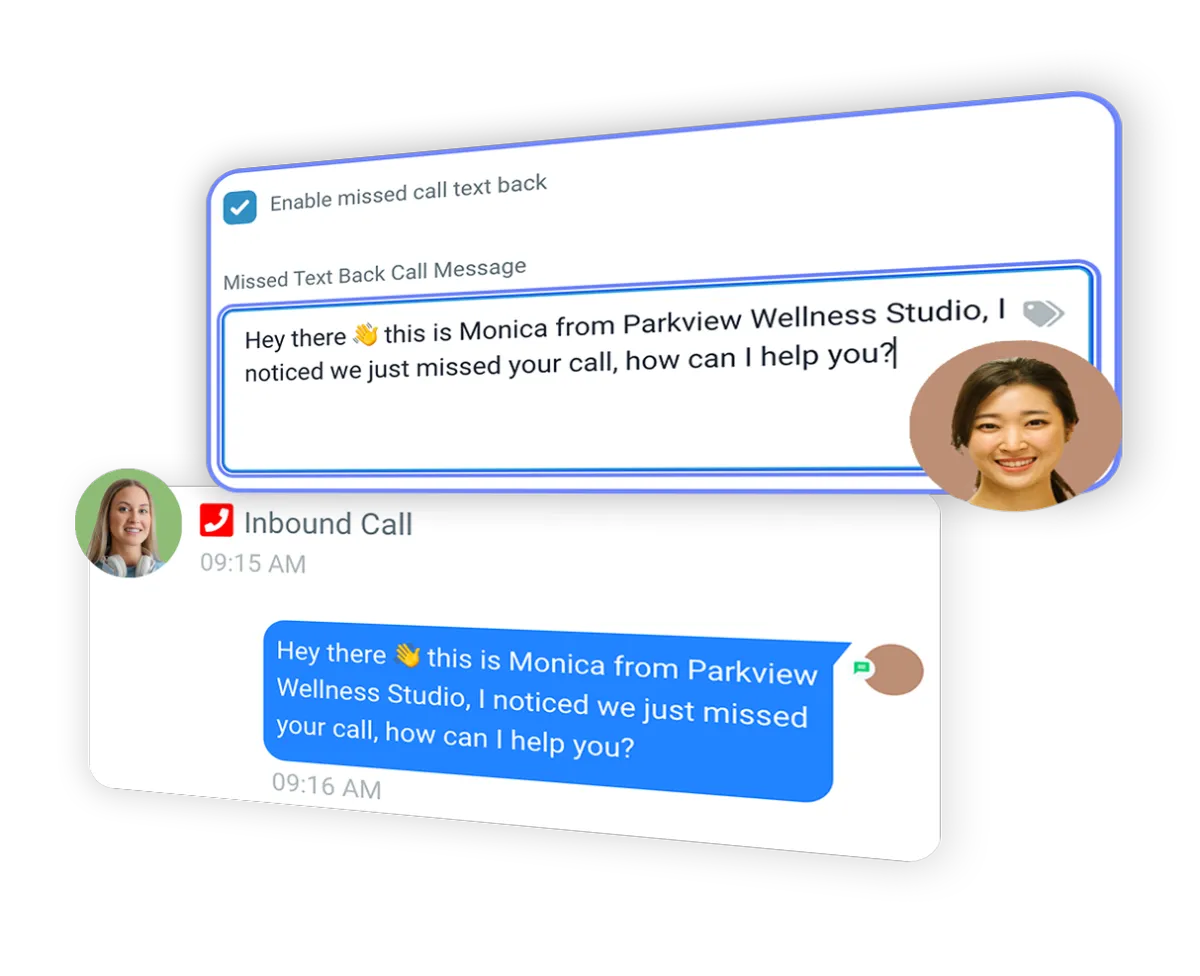

Avoid losing sales while you're away

Missed a call from a client? Our missed call text back captures leads for you, even when you're busy.

Text Notifications

Never miss a client's message with the text notifications

Get paid without any hassle in just 4 clicks.

Need a secure way to request and receive payments? Send quick invoices to clients via text or email. We integrate with Stripe and PayPal which means secure payments straight to your bank account.

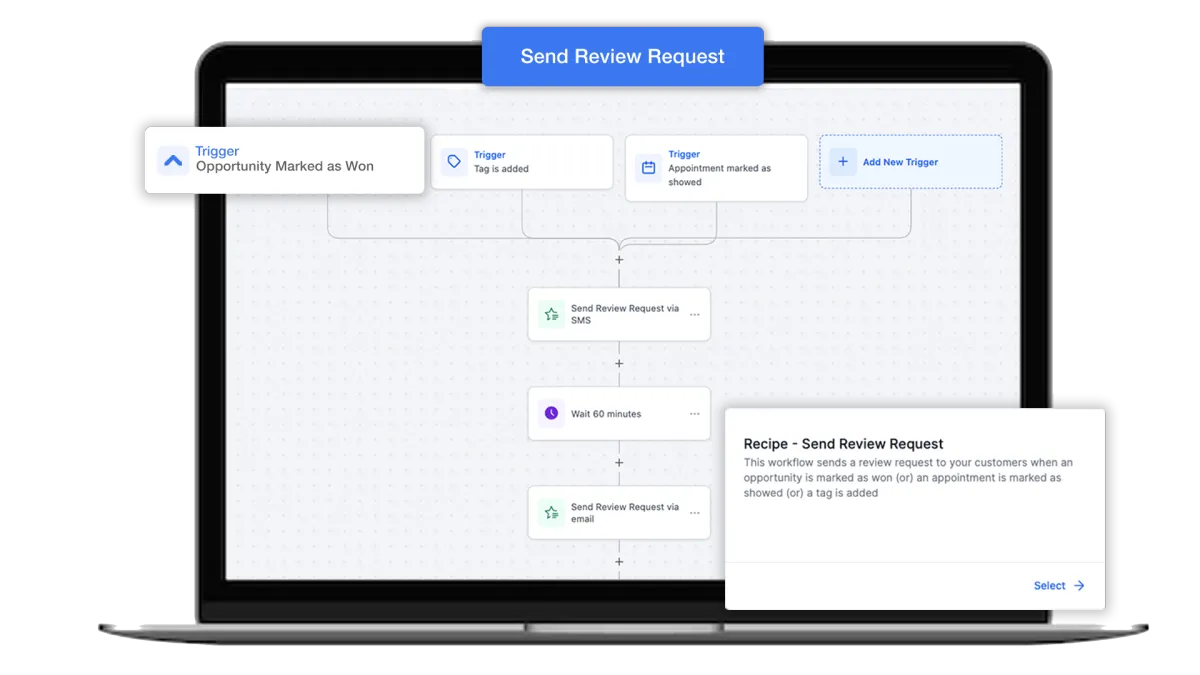

Your business, on autopilot.

Sending appointment reminders, get more Google reviews & more. Our workflow builder eliminates tedious manual tasks. Takes the heavy lifting off your shoulders.

Connects with the tools you're already using

FAQ

Do you have a free trial?

Yes we have a free 14 day trial! We want you to test our product for yourself and see all the features we have.

How do I access the software?

You can access our software from browser and you can also download our ios app from the app store.

How many users can I have on my plan?

With all of our plans you can have unlimited users on your account.

How do I cancel?

If you don't like our product, you can cancel anytime. Just log in to your account and from your account settings you can select "cancel account". You'll have to pay the remainder of the month if you are on the monthly payment plan.